Are you looking to improve the customer service of your bank? Do you want to automate the banking operations? With banking chatbot development, this vision becomes a reality. If you’re ready to upgrade your banking business to the next level of efficiency and customer satisfaction, you’re in the right place.

Let’s dive deep into the world of chatbots and their role in the future of banking.

Introduction

While working on a presentation, Alice remembers her credit card bill. She doesn’t want to switch between apps or dig through emails. She quickly asks her bank’s chatbot. Within seconds, it replies,

“Rupees 3000 due by the 25th.”

Alice sets up the payment and gets back to work.

Alice’s banking chatbot has become her trusted companion in the busy world, making her financial tasks effortless and quick.

Moreover, through banking chatbots, your bank is just a message away, ready to assist you anytime.

According to Forbes, AI tools like chatbots are expected to enhance banking industry revenue by 1 billion dollars in the next three years.

This article will discuss the development of a banking chatbot, AI chatbot use cases for banking and benefits.

Prominent Challenges a Banking Chatbot Can Solve

In our busy lives, handling banking-related processes can be challenging. Moreover, you must track your spending, pay your bills on time, and deal with unexpected costs. It can get pretty stressful.

That’s where banking chatbots step in to help. They’re like friendly digital helpers designed to make managing your money easier. Moreover, they’re here to simplify things and smoothly guide you through your banking journey.

Let’s explore some challenges in the banking sector and how banking chatbot development can solve them.

Overwhelming Customer Support Queries

Imagine a busy bank with lots of customers lining up for help. Sometimes, there are so many questions the human agents can’t keep up, causing delays and making people unhappy.

That’s where the banking chatbot comes in. Moreover, it’s like having a super-fast and always available digital helper.

Furthermore, it takes care of common questions, so customers get answers right away. Also, with chatbots around, the bank’s customer service is as smooth.

Meeting 24/7 Service Expectations

Customers today expect service around the clock, yet humans need rest. Moreover, chatbots never sleep. Even at 3 AM, it was helping a customer with a forgotten password or a late-night financial query. In addition, it’s like having a tireless employee who never takes a coffee break.

Awareness of Financial Products

Banks offer a variety of financial products and services, such as loans, savings, investments, insurance, etc. However, many customers are unaware of these options or how to benefit from them.

Moreover, a banking chatbot can teach customers about the bank’s offerings, provide personalized insights and recommendations, and guide them through the application process.

Inefficient Sales and Lead Generation

Banks need to generate and qualify leads to increase their sales and revenue. Moreover, the traditional methods of lead generation, such as cold calling, email marketing, or online ads, are often costly and ineffective.

A banking chatbot can engage with visitors on the bank’s digital platforms, such as website, app, or social media, and understand their needs and preferences. Also, the chatbot can then provide relevant information.

Getting Personal with Banking Chatbots

Customers want banks to understand them personally, but often, banks treat everyone the same way. Also, it can make customers unhappy, and they may even leave.

A banking chatbot can provide a personalized experience by learning from the customer’s behaviour, preferences, feedback, and context. In fact, the chatbot can then offer customized solutions, advice, tips, and rewards that match the customer’s profile.

Expensive Multilingual Support Team Management

Banks have customers worldwide, and they speak many different languages. However, hiring and managing a team of people who can speak all these languages can be challenging and costly.

But, a banking chatbot can understand a customer’s language and talk to them in their language. Furthermore, there is no need for a big multilingual team – the chatbot handles it all with the magic AI.

Real-Time Updates and Feedback Collection

Banks must keep their customers informed about the latest news, offers, events, policies, etc. They also want to know if the customers are happy with their service.

Moreover, a banking chatbot can provide real-time updates and feedback collection by using push notifications and surveys.

Banking Value Chain: Identifying Possible Banking Chatbot Use Cases

Have you ever thought about the chatbot integration touchpoints in the banking domain? We are exploring the banking value chain first. Then, we will identify the chatbot use cases for each of them. Come, let’s join us!

Customer Onboarding: The first step for any banking relationship is customer onboarding. Moreover, it includes account creation, KYC (Know Your Customer) verification and initial setup.

Account management: Self-help operations where customers keep track of their accounts, make changes quickly, and get help when needed. Moreover, effective account management ensures customers can manage their financial activities effortlessly and receive support when needed.

Financial Transactions: Transactions in banks refer to various economic activities customers can carry out. These include transferring money between accounts, paying bills, applying for loans, and conducting other monetary operations.

Customer Support: It is all about helping customers with their questions, resolving issues or complaints, and offering guidance as needed.

Wealth management in banks is a service that focuses on helping individuals and businesses achieve their financial goals and grow their wealth.

Digital banking in banks refers to using electronic platforms to perform banking activities. It includes managing accounts, making transactions, and accessing other financial services without visiting a physical branch.

Banking Chatbot Use Cases

We learned the different operations of banks from the banking value chain. Now, let’s see how AI chatbots for banking can carry out these operations.

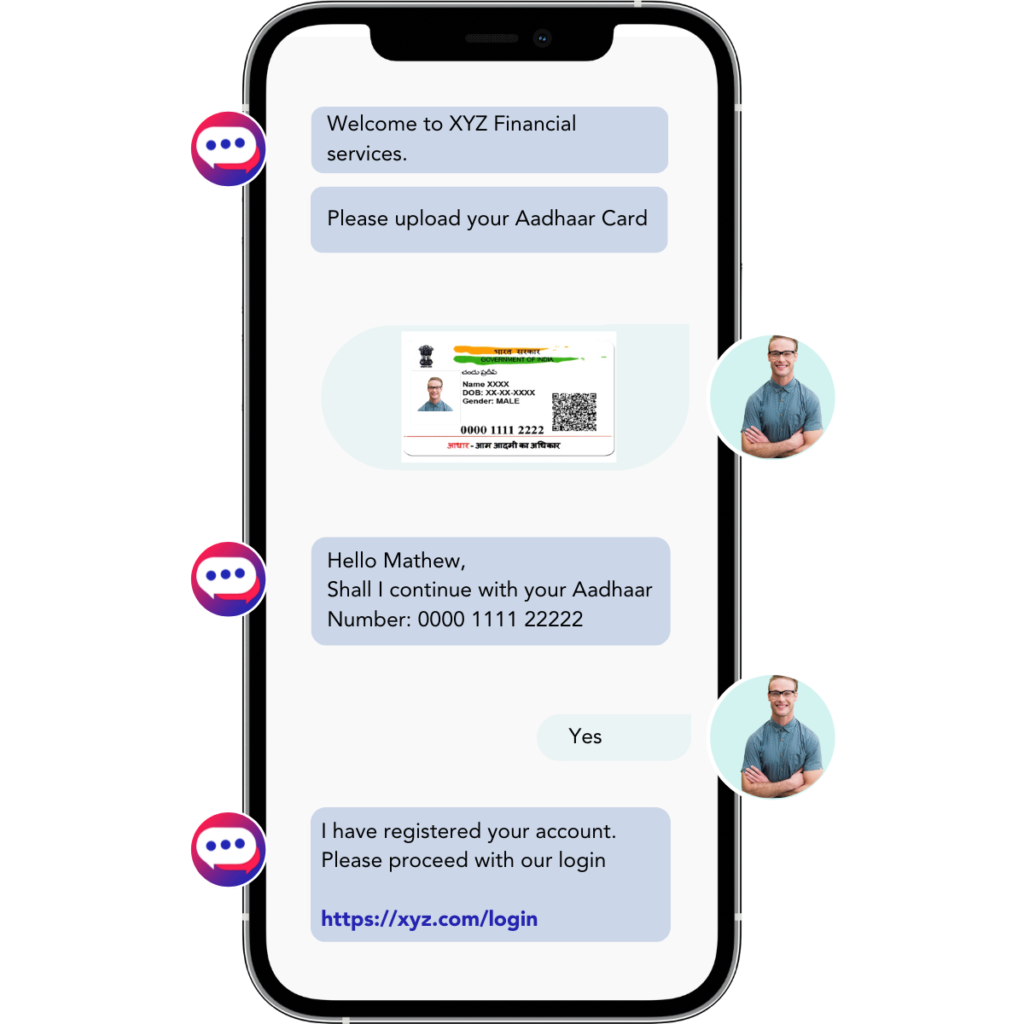

Customer Onboarding

AI chatbots are transforming how banks onboard new customers by offering a seamless, efficient, and interactive experience. Moreover, when a prospective customer visits the bank’s website or mobile app, the chatbot initiates a conversation, typically greeting the user and offering assistance.

Moreover, the chatbot guides the user through the account creation process, prompting them to enter necessary information such as name, email address, contact number, etc.

Let’s imagine a scenario. Mathew was looking to open a new bank account. He decided to open an account with Future Bank, which has a prominent online presence. When he enters the bank’s website, the experience will be seamless as the chatbot greets him and starts the onboarding process.

The chatbot asks for an ID card and cross-verifies the collected details. Also, with the integration of Document AI, a chatbot can reduce the overhead of your back-office team.

Account Management

Banks are now using AI chatbots to make managing accounts easier. Moreover, these chatbots quickly show your balance and past transactions when asked. They can also change account details for you without needing a person to help. Additionally, it makes banking faster and more user-friendly for everyone.

Mark is a busy professional. Also, he often needs help keeping track of his finances due to his hectic work schedule. Let’s see how he checks his account balance and updates his contact information through AI chatbots. This use case will enable the users to carry out self-help operations to manage their bank accounts.

Financial Transactions and Operations

AI chatbots in banking make tasks easier and quicker. Moreover, they let users transfer money simply by using voice or typing a command. For those looking to apply for loans, chatbots gather the needed information through a friendly chat and instantly update users about their loan status. In short, they’ve made banking smoother and more straightforward for everyone.

Picture a scenario. It was late at night, and Bella was going to sleep. Then, she remembers that she owes her friend Annie 1000 for last night’s dinner. She doesn’t want to log into her banking app, so she opens her bank’s chatbot using a voice command.

“Hey, send 1000 rupees to Annie”.

The bot replies instantly, as shown below.

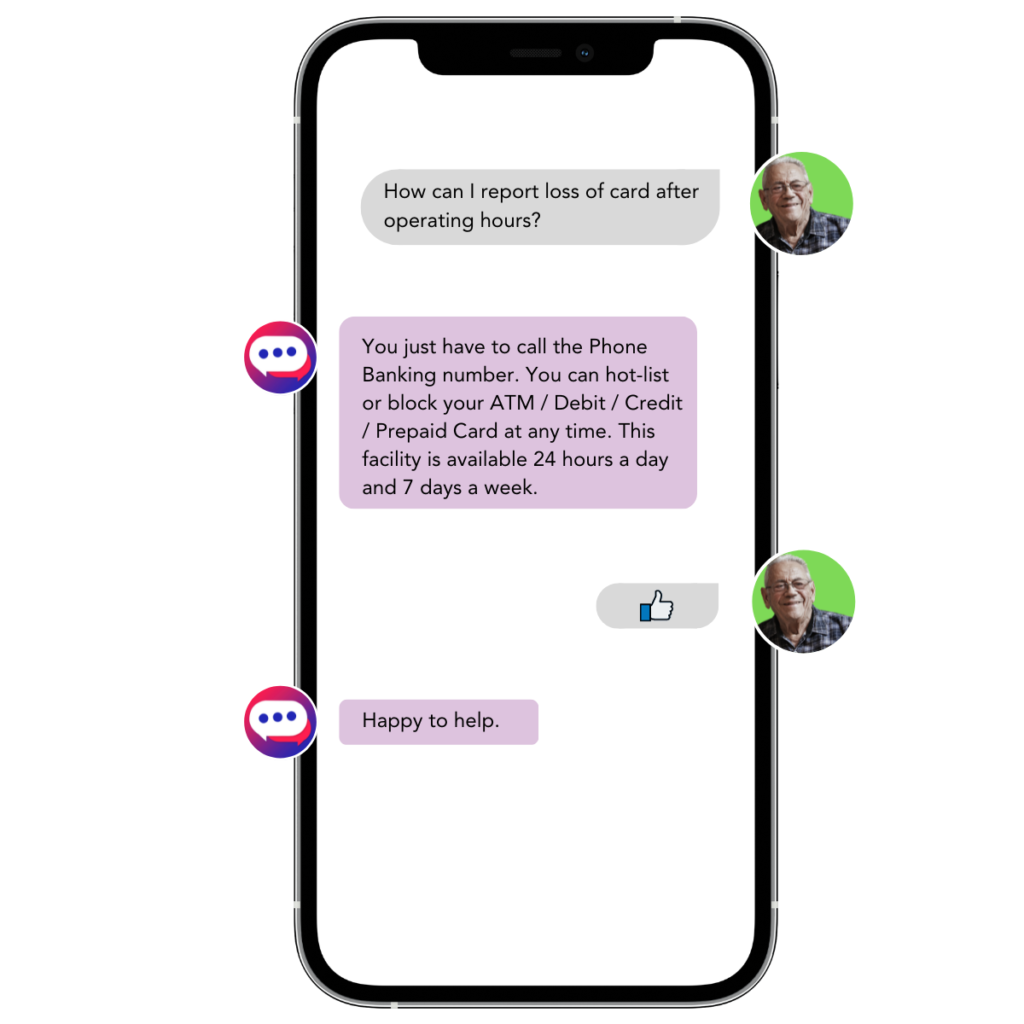

Customer Support

AI chatbots have become essential tools in banking customer support. Also, by answering routine questions, they significantly lessen the workload on human representatives, ensuring they can focus on more complex issues. Furthermore, these chatbots offer immediate resolutions for standard problems, ensuring customers get quick and efficient assistance without waiting in long queues or navigating through multiple menus. Essentially, they streamline the support process, making it more responsive and user-friendly.

Picture this. John lost his card, and now he wants to hotlist it.

So, John opens his bank’s app and clicks the “Help” icon. Instantly, the banking bot greets him. Now, let’s see how the chatbot handles this conversation.

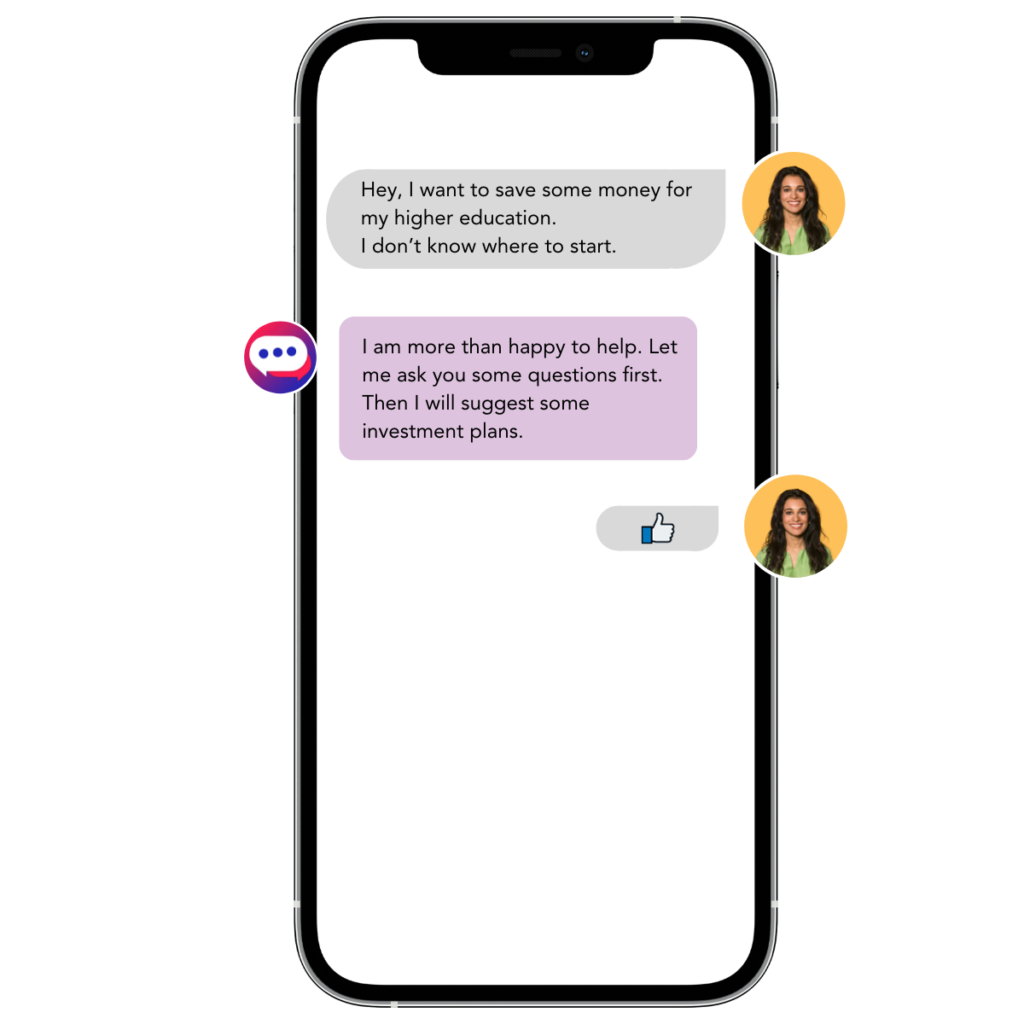

Wealth Management

AI chatbots in wealth management make smart investing more accessible for everyone. Moreover, these chatbots suggest tailored investment options by looking at a customer’s financial past and understanding their goals. It’s like having a personal financial advisor in your pocket, ensuring you get advice that fits your needs and goals. Also, it brings expert money advice to all, ensuring it’s timely and fits your finances.

Digital Banking

Chatbots play a pivotal role in modern digital banking. Furthermore, they act as digital guides, helping users navigate online banking tasks, from setting up accounts to making transactions.

Additionally, when users undergo problems, these chatbots are right there to troubleshoot common issues. Moreover, they simplify the digital banking experience, making it more user-friendly and efficient, ensuring that even those new to online banking can easily use it.

Emerging Conversational Banking Trends

Now, it’s clear how banking chatbot development will ease many banking operations through a conversational approach. Let’s explore some future conversational trends.

More human-like Conversational Banking

Banks started using chatbots to help customers. They were suitable for supporting and telling people about new bank offers. But sometimes, they would get stuck if you asked them something challenging.

Now, these chatbots have significantly upgraded with a new tech called LLMs. Moreover, they can chat with lots of people at the same time and can keep the conversation going without getting confused. It means the customers are more satisfied when they get the necessary assistance.

Emerging Conversational Banking Trends: The Power of Voice AI

Banks can significantly reduce costs by integrating voice AI, especially when managing tele-support teams for customer service and marketing operations.

In today’s fast-paced digital age, conversational banking isn’t just a trend; it’s a revolution. And what’s driving this revolution? Voice AI. Imagine casually chatting with your bank’s chatbot, like catching up with an old friend over the phone. That’s the charm of voice bots in banking.

Now, let’s explore the benefits voice AI offers to elevate the customer experience:

Convenience and Simplicity

Forget navigating tedious IVR menus. Also, with voice AI, customers can effortlessly voice their concerns in their preferred language.

Seamless Customer Support

Say goodbye to long waits on hold. Voice AI quickly addresses frequently asked questions, slashing wait and resolution times.

Security Reinvented

Voice AI doesn’t just offer convenience. Cutting-edge voice recognition allows for swift customer identification and authentication, providing secure access to their accounts. And the innovation doesn’t stop at authentication. Imagine a chatbot retrieving user details simply by recognizing their voice. It’s not just futuristic; it’s the next big leap in banking.

Integration with Personal Assistants

Voice AI easily integrates with popular personal assistants like Siri, Google Assistant, and Alexa. Now, banking is as simple as asking your phone a question.

Revolutionizing Campaign Calls

Voice AI doesn’t wait around. It handles cold calls proactively, promoting up-sells and cross-sells. Also, if a customer shows interest, the voice bot seamlessly escalates the call to the marketing team. And if it’s after business hours? The bot schedules a follow-up in the sales CRM efficiently.

Chatbots Making Payments

Now, with chatbots, you can just say,

“Pay James Rupees100,” and it does the job.

And guess what’s coming next? Soon, these bots can tell it’s you from your voice, so no more passwords! It’s like banking is becoming as simple as having a quick chat .

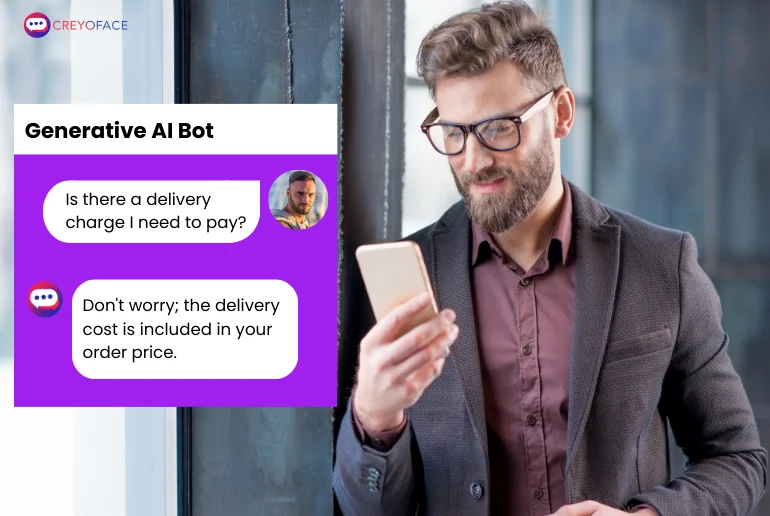

Integration of Generative AI

In the ever-evolving banking landscape, AI chatbots are no longer just a trend but a necessity. And what’s driving this transformation? The integration of generative AI in banking. Let’s dive deep into how generative AI reshapes the banking experience and why it’s the next big thing in banking chatbot development.

Legal Document & Clause Generation

Generative AI isn’t just about customer interaction; it’s revolutionizing backend operations, too. Imagine a system that can generate legal documents or specific clauses tailored to individual client needs. Moreover, it’s efficient precise, and reduces the margin for human error.

Product Design Tailored to User Personas

Are you planning to launch a new banking product? Generative AI has got your back. Take, for instance, the launch of a new pension scheme for millennials. Also, with the power of AI, banks can delve deep into user personas, understanding aspects like demographics, goals, and motivations. Additionally, it ensures the product design aligns perfectly with the target audience’s needs.

Empowering Contact Center Agents

Generative AI is transforming the way contact centers operate. It provides the ability to capture a snapshot of customer interactions, allowing agents to truly understand the essence of each conversation.

Additionally, it tracks the shift in customer sentiment from the start to the conclusion of an interaction, ensuring that agents remain informed about the customer’s feelings throughout.

Furthermore, this advanced AI doesn’t just passively analyze; it actively assists. During live interactions, it offers real-time coaching to contact centre staff, ensuring they handle situations optimally.

Beyond immediate interactions, generative AI, with the oversight of human experts, can predict and guide subsequent steps in a customer’s journey, streamlining the entire process.

Custom Knowledge Base for Bankers

Gone are the days when bankers and advisors had to sift through vast knowledge bases. Also, with a banking chatbot powered by generative AI, they can simply chat and fetch information about products and plans in real time.

- Fraud Detection:

One of the standout banking chatbot use cases is fraud detection. By analyzing patterns in existing data, generative AI can spot transactions that seem out of place. Detecting potential fraud early on can save banks significant money and protect customer trust.

Integration of advanced analytics and ML

Advanced tools such as advanced analytics and machine learning are used during the banking chatbot development. Moreover, it helps bots to communicate efficiently with customers. For example, when financial advisors use chatbots, they can quickly find out how risky it is to lend money to someone. Also, When a new customer onboards, the chatbot can suggest how much money the bank should allow them to borrow.

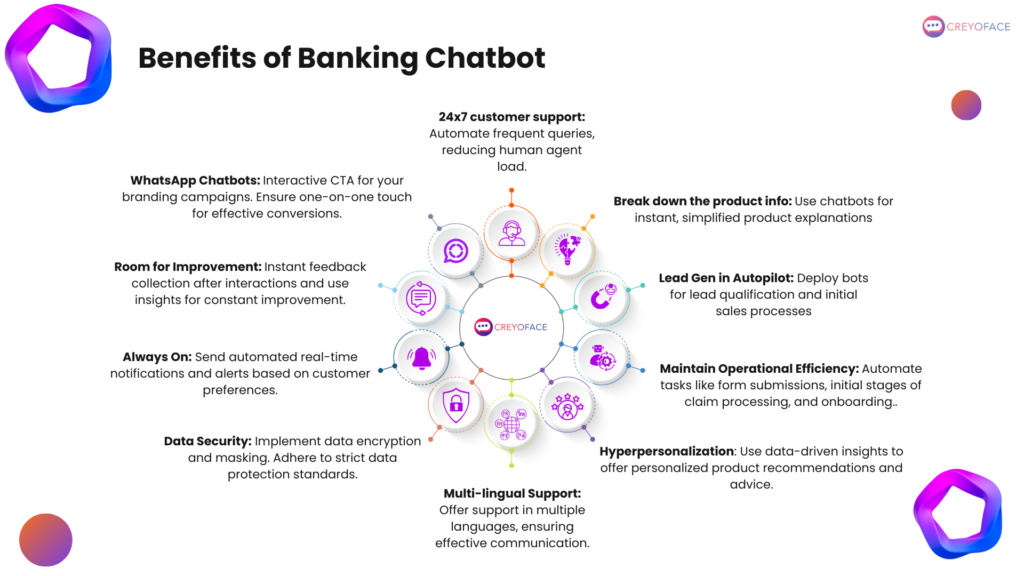

Benefits of Having a Banking Chatbot

A banking chatbot is like a friend you can chat with any time without waiting in line. Moreover, they’re like little helpers, making our bank tasks quick and easy. Let’s see some benefits of chatbots in banking.

24×7 Customer Support

Banking chatbots are available round the clock to handle frequently asked questions and routine queries, reducing the workload on human agents. Also, customers can get instant responses and assistance, even outside regular business hours.

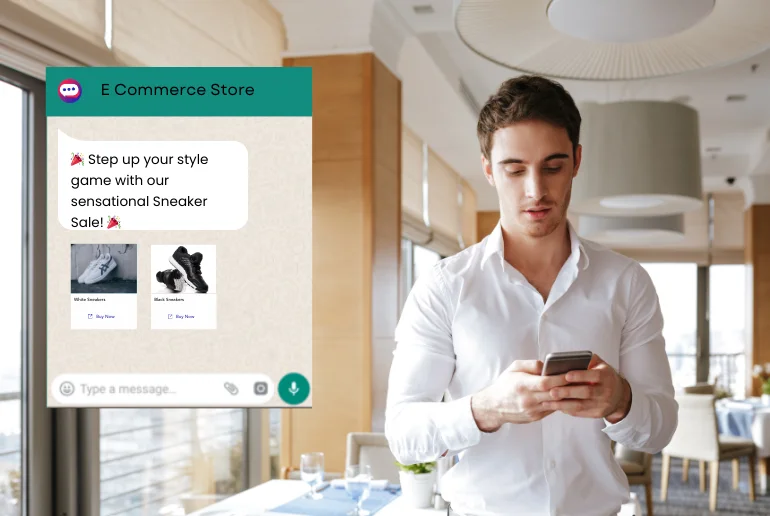

WhatsApp Chatbots

These chatbots provide an interactive way to engage customers for branding campaigns. They can offer one-on-one interactions, guiding users through services.

Feedback and Improvement

Banking chatbots can collect instant feedback from customers after interactions. Insights from this feedback help banks constantly improve their chatbot services, ensuring a better user experience.

Always On Notifications

Chatbots can send real-time notifications, and alerts based on customer preferences can be sent via chatbots. Moreover, it promptly informs customers about essential account activities, transactions, or alerts.

Data Security

Data encryption is critical in banking chatbots. So, these chatbots use strong security measures, like locking data in a digital vault, to ensure no one can access it without permission. It helps to protect customer’s private details.

Product Information

Chatbots break down complex banking product information into simplified, easy-to-understand explanations. They assist customers in understanding various financial products and making informed decisions.

Lead Generation

Chatbots can work in autopilot mode to qualify leads and initiate the initial stages of sales processes. Moreover, they engage potential customers, gather relevant information, and pass on qualified leads to human agents for further nurturing.

Operational Efficiency

Automation is critical to banking chatbots. In fact, they streamline tasks like form submissions, initial steps of claim processing, and onboarding, reducing manual effort and improving efficiency.

Hyper personalization

Banking chatbots use data-driven insights to offer highly personalized product recommendations, financial advice, and targeted campaigns. Moreover, this personalization enhances customer engagement and satisfaction.

Multi-lingual Support

In a diverse customer base, offering support in multiple languages is crucial. Banking chatbots can communicate effectively with customers in their preferred languages, ensuring effective and inclusive communication.

How to Develop a Banking Chatbot?

Banking chatbot development is like having a tireless and super-smart assistant in your bank’s corner. Moreover, these digital helpers work 24/7, answering your questions, making transactions a breeze, and even giving personalized tips. Also, they’re like the secret weapon that banks use to provide top-notch service, and save costs.

Creyoface can assist you with banking chatbot development. Moreover, You can create your banking chatbot in 5 simple steps.

- Register with creyoface and create a Chatbot using our templates

- Create workflow using drag-and-drop widgets

- Manage workflow using FAQ and context Understanding mechanism

- Customize Chatbot based on brand guidelines

- Deploy multichannel in under 5 minutes

Please read our guide on How to create an AI chatbot for free without coding to develop your banking chatbot.

Conclusion

Banks must make things easy for customers in today’s quick-moving digital world. That’s why banking chatbot development is essential.

Let’s recap what we have discussed in this article.

- The importance of chatbots in the banking domain.

- Some common challenges that chatbots can address in the banking sector.

- Detailed explanation of the different aspects of the banking value chain.

- Describing how chatbots streamline banking operations and enhance customer experiences.

- Highlighting the advantages of using chatbots in the banking sector.

- Introducing the Creyoface no-code platform for banking chatbot development.

Ready to Start. Sign in to Creyoface to develop your banking chatbots.

Ready To Explore?

Frequently Asked Questions?

A banking chatbot is a computer program powered by artificial intelligence (AI) that interacts with users in a conversational manner to provide banking-related services and information.

How can I access a banking chatbot?

You can typically access a banking chatbot through your bank’s website, mobile app, or messaging platforms like WhatsApp or Facebook Messenger.

What services can a banking chatbot provide?

Banking chatbots can offer various services, including account balance inquiries, transaction history, fund transfers, bill payments, account updates, loan applications, investment advice, and more.